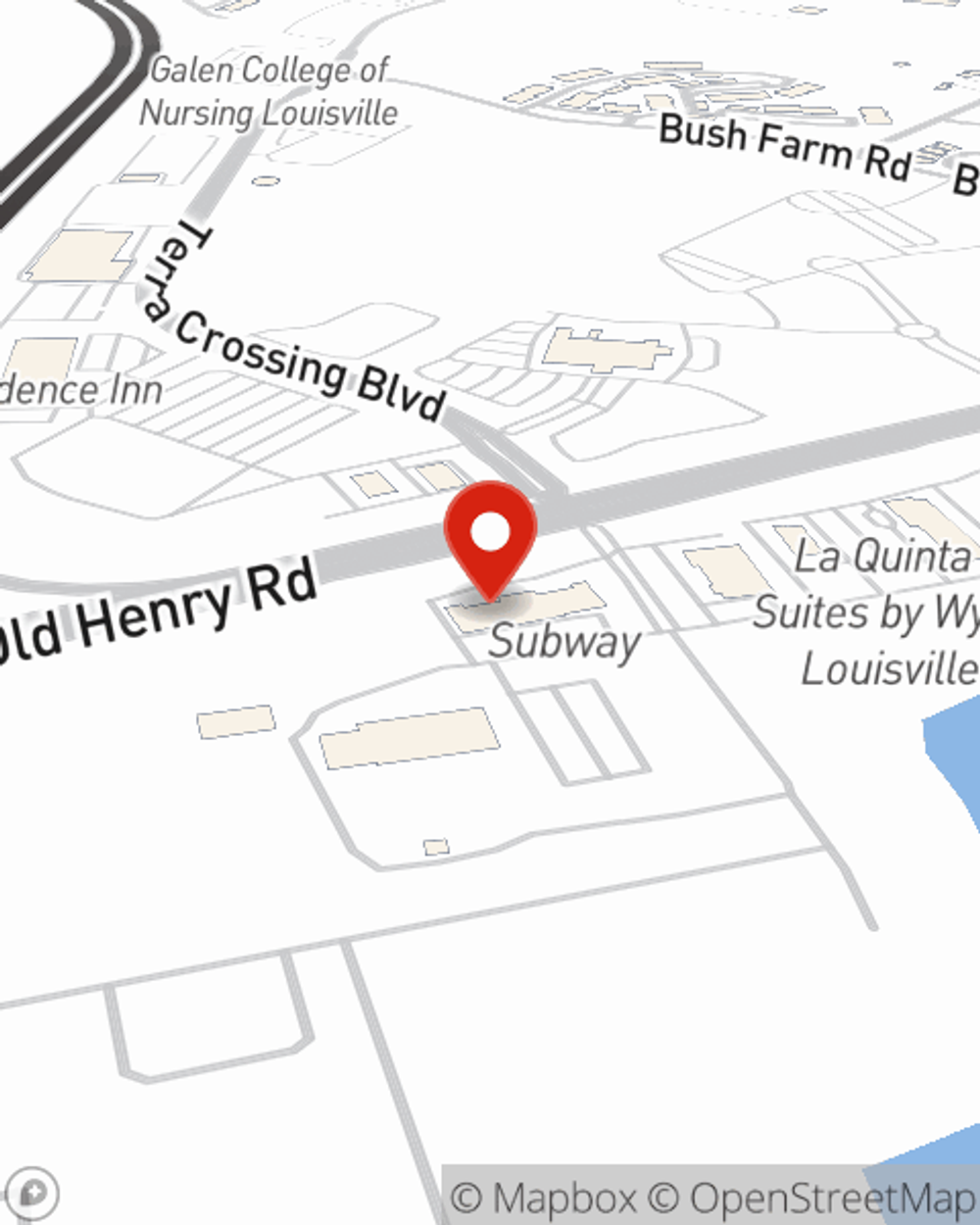

Business Insurance in and around Louisville

Get your Louisville business covered, right here!

No funny business here

- JEFFERSON COUNTY

- SHELBY COUNTY

- NEW ALBANY, IN

- NELSON COUNTY

- LEXINGTON, KY

- ELIZABETHTOWN, KY

- JEFFERSONVILLE, KY

- SIMPSONVILLE, KY

- JEFFERSONTOWN, KY

- PRP

Help Protect Your Business With State Farm.

Operating your small business takes creativity, hard work, and terrific insurance. That's why State Farm offers coverage options like a surety or fidelity bond, extra liability coverage, errors and omissions liability, and more!

Get your Louisville business covered, right here!

No funny business here

Keep Your Business Secure

At State Farm, apply for the great coverage you may need for your business, whether it's a window treatment store, a farm supply store or a pizza parlor. Agent Stepphone Mack is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Contact agent Stepphone Mack to consider your small business coverage options today.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Stepphone Mack

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.